Originally published on August 31, 2019 by Chris Quirk

Retro/Continuity/Pending and Prior Dates – What Are They?

These dates are your policy’s way of enforcing the basic principle of insurance that you cannot insure a known loss. In the insurance world, there is a common saying: ““you cannot buy fire insurance on a burning building.” Insurance is intended to protect against uncertainty by transferring part of that risk to the insurance company. Keep this in mind, you are transferring the risk of uncertainty to the insurance company. Once you determine that a loss is either occurring or imminent, you are unable to transfer the risk because the uncertainty has disappeared. Typical insurance is not intended to mitigate known losses. This principle is generally easy to enforce when the cause of loss and loss itself occur close in time. For example, if you discover that you are in the path of a specific hurricane, you will be barred from purchasing new insurance to protect your property from that hurricane (but not from future unknown hurricanes).

In the executive and professional liability world, there is often a long latency period between the cause of loss and the financial loss itself. For example, assume a company was providing business services to a client. If the company provided negligent services (typically called a “wrongful act”), the client may not file a lawsuit (typically called a “claim”) for a long period of time. The claim may not be led against the company for months or even years later. The delay between the act and the claim can create a whole host of scenarios where a company may try to protect itself against a known or expected loss in violation of the aforementioned principle. Insurance companies use these dates to enforce the principle against their Insureds.

BEFORE WE GET INTO THE MECHANICS OF EACH, YOU MUST ABSOLUTELY UNDERSTAND THAT INSURANCE COMPANIES AND PROFESSIONALS, FOR ONE REASON OR ANOTHER, USE THE NAMES INTERCHANGEABLY. ONE PERSON (INCLUDING MYSELF) MAY USE ONE TERM TO DESCRIBE ONE CONCEPT AND THIS MAY DIFFER FROM ANOTHER PERSON. YOU MUST NOT ASSUME WHAT THE SPECIFIC CLAUSE IN YOUR POLICY IS DOING JUST BY READING THE LABEL. IT IS PARAMOUNT THAT YOU ACTUALLY READ THE POLICY TO UNDERSTAND WHAT IS HAPPENING. I WILL SHOW YOU EXAMPLES AT THE END OF THIS ARTICLE OF THESE TERMS BEING USED INTERCHANGEABLY.

How they Work

These Dates typically manifest themselves in the exclusions in your policy, though sometimes they are found in the insuring agreements. Assuming that the claim occurs and is led during the policy period, the policy clause where the date is invoked requires the reader to ask a specific question. Depending on the answer, the policy may or may not cover a particular claim. Here are the questions reduced to their simplest forms (keep in mind that the terms are often used interchangeably):

- Retro Date – When did the first wrongful act or event occur?

- Continuity Date – When did ‘certain people’ gain ‘knowledge’ that the wrongful act could lead to a claim?

- Pending or Prior Date – To what prior legal proceedings is the current claim related?

Retro Date

“WHEN DID THE FIRST WRONGFUL ACT OR EVENT OCCUR?”

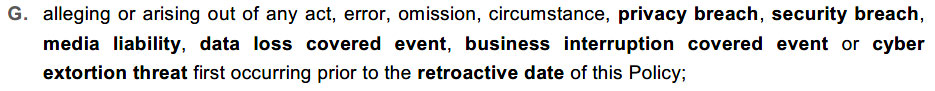

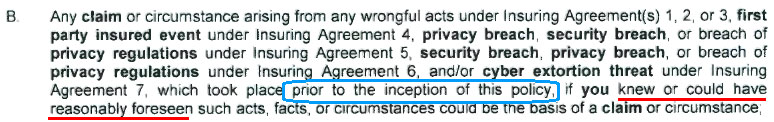

The Retro Date is typically enforced through your policy’s “prior acts exclusion.” The only variable with the prior acts exclusion is the timing of wrongful act or event in relation to the Retro Date stated on the policy. Here is an example that was found in a Cyber policy, but is

typical for other policies as well:

Notice what the prior acts exclusion is saying… the policy will not cover any claim “arising out of any wrongful act or event that occurs prior to the retro date specified on the policy.” The questions that must be answered are: “On what date did the first act or event occur?” and “Is that date prior to, or later than, the Retro Date on the policy?” Assuming a claim is led during the policy period, coverage will only be provided if the wrongful act occurs after the Retro Date on the policy. Here are a few examples that illustrate the concept:

WRONGFUL ACT OCCURS PRIOR TO THE RETRO DATE

Here, the insured bought a policy on July 1, 2019, with a specified Retro Date of July 1, 2018. On December 1, 2019, the insured is served with a lawsuit from a client alleging a wrongful act occurring on March 1, 2018. There is no coverage here, despite the claim occurring within the policy period, because the alleged wrongful act occurred prior to the Retro Date.

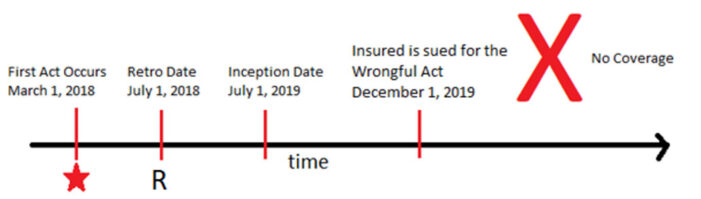

WRONGFUL ACT OCCURS AFTER THE RETRO DATE

In this scenario, the insured bought a policy on July 1, 2019, with a specified Retro Date of July 1, 2018. On December 1, 2019, the insured is served with a lawsuit from a client alleging a wrongful act that occurred on October 1, 2018. Coverage is provided in this scenario because the claim was led during the policy period, alleging an act occurring after the Retro Date. It does not matter that the wrongful act occurred prior to the date the Insured first bought the policy.

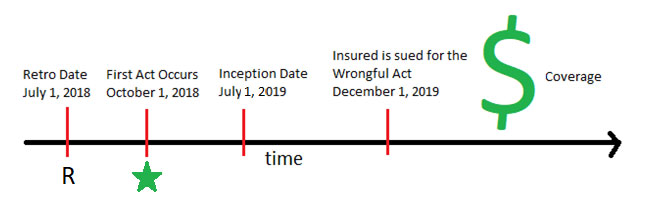

ONE WRONGFUL ACT OCCURS PRIOR TO THE RETRO DATE, ANOTHER OCCURS AFTER

In this scenario, the insured was sued during the policy period for two different wrongful acts, with one occurring prior to the Retro Date and one occurring after. If the two acts are sufficiently interrelated, or if the prior acts exclusion has an absolute or super-absolute preamble, then you will have no coverage for any part of the claim because the first wrongful act occurred prior to the Retro Date. If the stars align, circumstances surrounding the claim are just right, and you have a “for wording” preamble, you may be able to get coverage for that part of the claim involving only the second act (assuming it is truly separate and distinct from the first act) because it occurred after the Retro Date. However, in the vast majority of instances, the second wrongful act will be sufficiently related to the first act (which predates the Retro Date) so that coverage is excluded for the entire claim.

Continuity Date

“WHEN DID ‘CERTAIN PEOPLE’ GAIN ‘KNOWLEDGE’ THAT THE WRONGFUL ACT COULD LEAD TO A CLAIM?”

The Continuity Date is typically enforced through your policy’s “prior knowledge exclusion.” The prior knowledge exclusion has 3 important variables (in contrast to the Retro Date’s single timing variable). The first variable involves the timing of when certain people among the Insured gain knowledge that a prior wrongful act could lead to a claim. Notice the similarity to, but contrast with, the Retro Date – the Retro Date focuses solely on when the Wrongful Act itself takes place, whereas the Continuity Date focuses on when the Insured gains knowledge that the wrongful act could lead to a claim. The timing variable can only be determined after solving the other two. The second variable involves asking what constitutes “knowledge” for the purposes of the prior knowledge exclusion. The Third variable involves asking whom at the insured must have this “knowledge.”

FIRST VARIABLE – TIMING

The timing variable for the Continuity Date operates identical to the way it does for the Retro Date. The only difference here is that our focus shifts from when the wrongful acts occur for the Retro date, to satisfaction of two below variables for the Continuity date. If both variables are satisfied on a date prior to the Continuity Date specified on the policy, then the prior knowledge exclusion will exclude the claim just like how the prior acts exclusion will deny the claim if the wrongful act pre-dates the Retro date.

SECOND VARIABLE – ACTUAL KNOWLEDGE OR CONSTRUCTIVE KNOWLEDGE

There are two ways for the Insured to have “knowledge” that a wrongful act could lead to a claim.

The first is actual knowledge – the Insured knows or believes that the wrongful act will lead to a claim. This can happen in a number of ways. For example, an attorney representing a client has informed the Insured via telephone that a lawsuit will be led unless they meet and negotiate a settlement regarding a recent wrongful act that impacted the attorney’s client.

The second is constructive knowledge- the insured would have constructive knowledge if they could have reasonably foreseen that the wrongful act could lead to a claim. Note that even if the insured was not aware that the wrongful act could lead to a claim when they bought the policy, they will be imputed with constructive knowledge if it was reasonably foreseeable that the wrongful act could lead to a claim. The insured is not allowed to be ignorant of whether a future claim is reasonable or likely.

It is ultimately a judgment call by the fact-finder for whether or not a claim was reasonably foreseeable after taking into account the totality of the circumstances surrounding the prior wrongful act. In these situations, a dispute with the Insurance Company may ensue, which is generally resolved either internally, by a State or Federal Court, or through some alternative dispute resolution process.

Prior knowledge exclusions typically come in two forms with respect to this variable. Either they require only Actual Knowledge, or they require Actual or Constructive Knowledge in order to trigger. Exclusions limited only to Actual Knowledge provide a bene t to the Insured by narrowing the scope of the exclusion. Here are two examples:

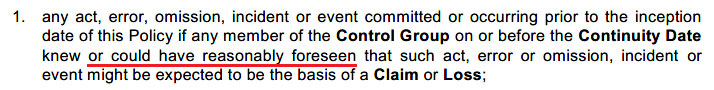

COMBINED ACTUAL & CONSTRUCTIVE KNOWLEDGE

Under this prior knowledge exclusion, a claim will be excluded if the Insured knew or could have reasonably foreseen that prior wrongful act could lead to a claim. Even if they didn’t know it would lead to a claim, if such a claim were reasonably foreseeable to a neutral fact-finder then the claim will be excluded.

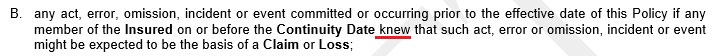

ACTUAL KNOWLEDGE ONLY

Under this prior knowledge exclusion, the claim will be excluded only if the Insured knew or believed that the prior wrongful act would lead to the claim. There is no component asking whether the claim would be reasonably foreseeable under the circumstances. Take this with a grain of salt, however. Although this does provide a benefit to the insured by eliminating reasonably foreseeable claims from the exclusion, this does not mean the Insured is entitled to be willfully ignorant. In a situation where the insured is determined to be willfully ignorant, a Court would likely find that they had Actual Knowledge and uphold the exclusion.

THIRD VARIABLE – WHO KNEW?

The third variable that influences the applicability of the prior knowledge exclusion is with respect to who had knowledge. Some exclusions may apply based on the knowledge of any employee or contractor affiliated with the company, while others may only apply to the knowledge of the company’s leadership. This has important implications for many companies, especially those with large numbers of employees. Consider a scenario where a low-level hourly employee makes a mistake, causing a client financial loss. In fear of losing their job, the employee does not report the error and instead covers it up. Later, the company’s senior management discovers the situation after being served with a lawsuit.

Assuming that the employee’s knowledge pre-dates the Continuity Date, the claim will be excluded if the prior knowledge exclusion applied to all Insureds because the employee qualifies as an Insured. If the prior knowledge exclusion was restricted only to the company’s senior management, the claim would be covered because the employee is not a member of this group.

Prior knowledge exclusions come in two forms with respect to this variable. Either the exclusion will apply to knowledge held by any Insured, or it will apply to only knowledge held by a specified group of individuals. Here are examples:

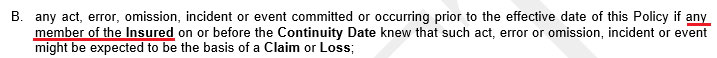

ANY INSURED (INCLUDING LOW-LEVEL EMPLOYEES AND INDEPENDENT CONTRACTORS)

In this version, prior knowledge by any Insured, even the low-level employee or independent contractor, will be considered for the purposes of the prior knowledge exclusion. If a low-level employee has knowledge of a potential future claim (pre-dating the company’s Continuity Date) but conceals it from senior management, the claim will excluded under this language.

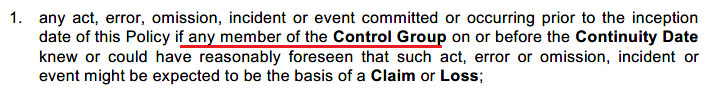

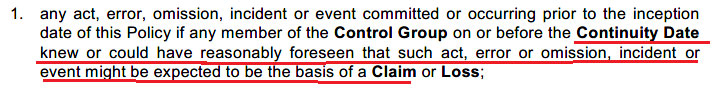

SENIOR MANAGEMENT ONLY (IN THIS POLICY REFERRED TO AS A CONTROL GROUP)

In this version, only the knowledge of the Control Group is considered. This particular policy defines Control Group to be the company’s C-level executives. Under this version, if a low-level employee gains knowledge prior to the Continuity Date, this knowledge will not be considered for the purposes of the prior knowledge exclusion because the low-level employee is not a member of the Control Group. As a result, the Claim will be covered.

All three variables must be satis ed in order for the prior knowledge exclusion to deny a claim. Insureds would be wise to try and remove this exclusion if possible, but if not, tweak these variables to narrow the scope of the exclusion as much as possible.

NO CONTINUITY DATE, NO PROBLEM?

Not exactly. Even if your policy doesn’t specify a particular date, the concept can still exist in your policy. This is probably even more nefarious because it is very well hidden, and because the date itself may change from year to year. Consider the below example:

This prior knowledge exclusion doesn’t reference a specific date, instead saying the “inception of this policy.” Not only is this easy to miss, since the policy declarations page didn’t specify a particular date, but every time the policy is renewed the continuity date is reset to the new policy’s inception. This can have catastrophic consequences, especially for acts occurring at the very end of the policy period. Consider this hypothetical scenario:

With 3 days left in the policy period, the CFO of the Insured becomes aware that the company made a mistake causing a $1.4 million loss to their client. The CFO spends the next week investigating the circumstances surrounding the error, while renewing the expiring E&O policy with the above language, and without notifying the insurance company of the potential for a claim. 90 days later, the company receives a demand letter resulting from the error and the CFO forwards the claim to the Insurance Company expecting coverage under the current policy. In this scenario, this claim would be excluded due to the above wording because the CFO gained knowledge that a claim was not only reasonably foreseeable, but likely imminent, 3 days before the inception of the current policy. Unfortunately for the Insured, this policy’s Continuity Date was

“inception of the policy,” and so the CFO’s knowledge of the potential claim pre-dated the Continuity Date by 3 days, thereby precluding them from obtaining coverage for the claim. A brutal result.

TEST YOUR SKILLS!

Consider the sample language provided in the previous section. Identify what variables this exclusion invokes:

- Timing – what date are we concerned with?

- Actual or Constructive Knowledge?

- Whose Knowledge?

Answers at the bottom of the article.

Pending and Prior Date

“TO WHAT PRIOR LEGAL PROCEEDINGS IS THE CURRENT CLAIM RELATED?”

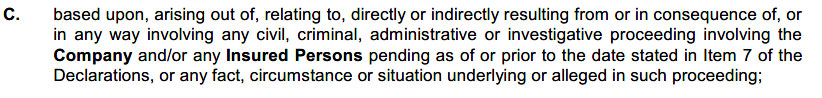

In the corporate world, legal proceedings have a tendency to beget more legal proceedings. If a present or future claim is connected or related to some prior proceeding (that pre-dates the Pending and Prior Date on the policy), then the present or future claim is going to be excluded. Here is an example Pending and Prior exclusion from a D&O policy:

Whether or not the present or future claim is related to the prior legal proceedings will end up being a judgment call based on the concept of interrelatedness. Consider the following example:

A company finds itself under investigation by the FTC on January 1, 2019, for claims of deceptive business practices. The FTC levies a ne of $5 million on March 1, 2019. After learning a painful lesson, the company buys a D&O policy on April 1, 2019, including an April 1, 2019 Pending and Prior Date.

Unfortunately the $5m ne was catastrophic for the company. They had set aside money to break into an emerging new market upon which they were relying to build a new revenue stream, but were no longer able to do so after paying the FTC ne. 12 months go by and the company severely underperforms projections leading to a D&O claim by the shareholders in 2021. The complaint specifically mentions the 2018-2019 FTC proceeding and subsequent ne as one reason for the underperformance, and as evidence of negligence by company management.

In this situation, the shareholder claim arises out of, and is sufficiently related to, the prior FTC proceeding and so it is likely going to be excluded. The FTC proceeding existed on January 1, 2019, and thus pre-dates the April 1, 2019, Pending and Prior Date on the policy. If the earliest legal proceeding to which the current claim is related pre-dates the Pending and Prior Date, the claim will be excluded.

Interchangeable Terminology

Here are some examples of the terms being used interchangeably in the industry. My terms are by no means right, they are just what I have grown accustomed to using. Everyone uses something different, so be sure to carefully consider what concept your policy invokes before jumping to conclusions.

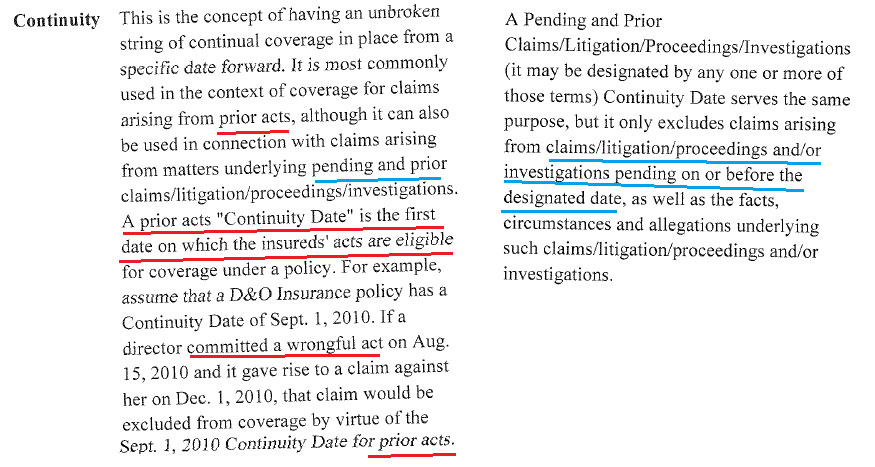

“CONTINUITY” TERMINOLOGY USED TO DESCRIBE PRIOR ACTS & PENDING AND PRIOR PROCEEDINGS

This excerpt is from a book by my good friend Larry Goanos titled “D&O 101 – Understanding Directors & Officers Liability Insurance. A Holistic Approach.” He uses the Continuity Date to apply to both when the Act occurs (red) and pending and prior proceedings (blue). Does not even mention the concept of prior knowledge. Instead of focusing on the name, focus on what question is being asked. By the way, this is an excellent book that I highly recommend reading for anyone in the Insurance business.

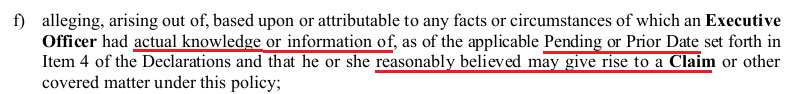

“PENDING OR PRIOR” TERMINOLOGY USED TO DESCRIBE PRIOR KNOWLEDGE

The policy example above uses “Pending or Prior” terminology to describe the concept of prior knowledge, which I’ve referred to as Continuity. Meanwhile, the example below calls the same concept “Continuity”:

Sensei Says

Do not jump to conclusions just by glancing at the terminology that your policy uses. Carefully read the terms used by the policy and try to understand what concept is being applied. What variables does the policy language consider?

- When the act occurred?

- When knowledge was gained?

- Interrelatedness to current and past legal proceedings?

Your policy may include any combination of the three concepts and it may call them something different. Be sure to read the terms and conditions of your policy fully and thoroughly to understand which of these concepts applies and with what scope. These concepts have significant impact on the outcome of claims, and inferior language in your policy can put your business at risk.

TEST YOUR SKILLS – ANSWERS

Consider the sample language provided in the previous section. Identify what variables this exclusion invokes:

- Timing – Inception date of the policy, whenever that is. Looks like when the policy renews, the date will be advanced a year. Terrible!

- Constructive Knowledge – due to the “or could have reasonably foreseen” language

- Whose Knowledge – Depends on how You is defined. Cannot be determined without seeing the definition of You. Good eye!