Originally published on July 30, 2020 by Chris Quirk

What is the Hammer Clause?

The hammer clause is a coverage condition found in many management and professional liability policies. It works to cap the liability of the Insurance Company in the event that plaintiff offers you a settlement, but you reject it and continue defending. If you choose to reject the settlement offer and continue to ght, the Insurance Company will only cover you for the proposed settlement amount, and defense costs incurred up until you received the settlement offer. All additional costs will be excluded.

To illustrate the concept, assume you are in the process of defending a claim and plaintiff offers you a settlement. By the time you receive the settlement offer, you’ve spent $25,000 on lawyers’ fees and other defense costs. The settlement offer is for$100,000. Assuming you have coverage for the claim, subject to a$5,000 retention, if you choose to accept the settlement then the insurance company will cover you for $25,000+100,000, minus 5,000 which you pay due to the retention, or a total of $120,000.

Let’s assume that you reject the settlement, go to trial, lose, take it up on appeal, and lose again. The whole process cost a total of

$60,000 in defense costs (an additional cost of $35,000 after you rejected the settlement) and the jury awarded $270,000 in damages (an additional indemnity of $170,000) for a total cost of $330,000. If your policy has a hammer clause, the most the policy will cover is $120,000 or the amount for which the claim could have been settled, had you accepted the settlement offer.

There are different variations of the hammer clause that tweak the ability of the Insurance Company to cap its losses. The variation described above is a full hammer clause, which is the worst variation possible. Insureds who receive no extra coverage from the Insurance Company if a claim leaks over the original settlement offer.

There are other variations where you share the additional costs with the Insurance Company. Some policies allocate the costs on a percentage basis. For example, some provide an 80/20 split where you are responsible for 20% of additional costs over the proposed settlement. 70/30, 60/40, and 50/50 splits are common as well. Some policies distinguish between defense costs and indemnity (settlement or judgment damages) and will fully or partially cover additional defense while not covering additional indemnity at all. There may be other unexpected effects as well – such as where an Insurance Company will stop defending the claim, forcing you to defend yourself. Below are some examples.

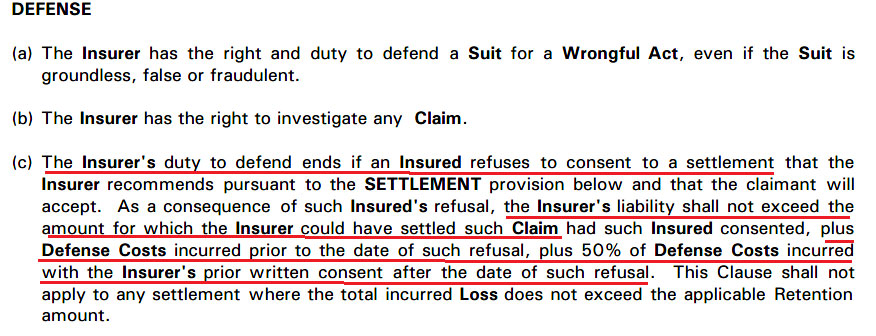

50/50 Defense Costs; 0/100 Indemnity (in Insurance Company’s favor) and Carrier relieved of Duty to provide defense

This variation the 2nd harshest one I have personally seen, just above the full hammer clause where the Insurance Company caps its liability entirely. This version states that it will only cover 50% of additional defense costs- notice that it provides nothing for additional indemnity. Applying this language to the example settlement described above, this policy would only cover half of the additional defense costs ($35,000*0.5), or another $17,500 in coverage. Total coverage provided by your policy would be the original settlement cost ($120,000) plus half of the additional defense costs ($17,500) or $137,500 on a $330,000 loss. As a side effect, the carrier also relinquishes it’s duty to defend which means you will have to direct your defense instead of the Insurance Company, which is just another burden on you.

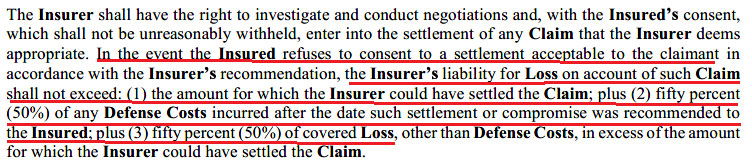

50/50 Defense Costs + Indemnity

This variation is fairly typical. Applying this language to the example settlement described above, this policy would cover half of the additional defense ($35,000 * 0.5) plus half of the additional indemnity ($170,000 * 0.5) or another $102,500. Total coverage provided by your policy would be the original settlement cost ($120,000) plus half of the additional defense costs ($17,500) plus half of the additional indemnity ($85,000) or $222,500 on a

$330,000 loss.

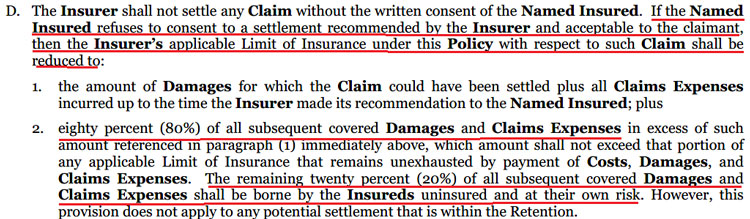

80/20 Defense Costs + Indemnity

This variation is the best version that is widely available, unless you don’t have a hammer clause at all which would be ideal. Applying this language to the example settlement described above, this policy would cover 80% of the additional defense ($35,000 * 0.8) plus 80% of the additional indemnity ($170,000 * 0.8) or another$164,000. Total coverage provided by your policy would be the original settlement cost ($120,000) plus 80% of the additional defense costs ($28,000) plus 80% of the additional indemnity ($136,000) or $284,000 on a $330,000 loss.

In all cases the carrier is trying to relieve itself from some part of their liability if you choose to reject an otherwise covered settlement offer. Be sure to read your policy to determine whether it contains a hammer clause, and if so, what the terms are.

When is the Hammer Clause important?

The hammer clause becomes important when Insureds have a vested interest in defending themselves that may outweigh the interest in settling the present claim. The foremost coverage that comes to mind is Employment Practices Liability.

EPL insurance covers Insureds for claims against them by employees alleging discrimination, sexual harassment, or various other prohibited employment acts. With this line of coverage, Insureds have a very strong interest in defending themselves, lest they appear to be a weak target for future unscrupulous and opportunistic claimants.

I worked with one Insured who placed an EPLI policy having a $25,000 retention and a 50/50 defense+indemnity hammer clause similar to the one sampled above. They received an EEOC complaint from an employee alleging discrimination for various alleged wrongdoings. The Insured vehemently denied these allegations and prepared to mount a rigorous defense with help from the Insurance Company until they received a $15,000 settlement offer from the claimant’s attorney. At the time, all parties believed that it would cost more to defend the case to successful resolution than it would be to simply accept the settlement.

The Insurance Company eagerly lobbied for settlement because the amount was below the policy retention, so they would pay nothing. But settlement was also Insured’s favor, the Insurance Company claimed, because it would cost less than fighting the case to resolution. In order to pressure the insured into accepting the settlement, the Insurance Company invoked the policy’s hammer clause, thus shifting half of all costs over $15,000 back onto the insured. Reluctantly, the Insured settled the claim.

In the next 6 months, the Insured received 6 similar complaints from individuals known to be friendly with the original claimant, each seeking a similar settlement based on a similar but separate set of alleged facts. While I cannot prove my opinions, this reeks of opportunistic plaintiffs seeking a quick payday from a vulnerable defendant. To make matters worse the Insurance Company held each claim to be separate from each other, so a separate $25,000 retention applied to each claim. By the end of the policy period the Insured had incurred around $80,000 in uninsured losses despite paying premium to cover this exposure.

In the EPL space, it is paramount that Insureds be able to fully defend themselves as a way to deter future frivolous claims. Had the policy not had a hammer clause, the Insured in the above example likely would have rejected the settlement and defended the claim. Assuming the defense led to a dismissal, the Insured probably would have avoided the future 6 claims and the losses associated with them.

Directors and Officers liability coverage is another line where the hammer clause becomes important. This is because in many claims personally involving the D&Os, the settlement often involves an allocution by the defendant(s) admitting guilt. Defendants rarely want to admit guilt, and so these settlements are typically rejected. Rejection of such settlement offers will trigger the policy’s hammer clause and limit coverage according to the terms of the policy. Avoid this result at all costs.

Contrast this to a coverage like Cyber, disclosure of con dential consumer information leads to lawsuits against the Insured. In these scenarios, the Insured’s culpability is given by virtue of having a data breach. I have never heard of a company looking to reject a data breach settlement that would otherwise be covered by an insurance policy. There is no reason to reject it. It does not involve opportunistic plaintiffs like with EPLI, nor does it involve admission of personal guilt like in the D&O space. Without a reason to reject the settlement, the hammer clause becomes an inert non-issue for these types policies. Despite having hammer clauses, I have never seen one come into play in any single cyber claim. Every breach victim I have worked with wants to simply settle the claim and move on.

Sensei Says

D&O policies should never have a hammer clause. Rigorously fight them off or place coverage with a carrier that does not have a hammer clause. This coverage, first and foremost, exists as a last line of defense to protect your personal assets when corporate indemnity fails. Many D&O policies do not have hammer clauses, but some do. Beware.

EPLI policies typically have hammer clauses, so seek to negotiate them strongly. If cannot remove the hammer clause entirely, negotiate the percentages in your favor as much as possible. Make sure coverage applies to both additional defense costs and additional indemnity. Some carriers may offer alternative enhancements such as “aggregate retentions,” which eliminate the policy retention once the Insured pays a specified amount in a single policy period (usually 2x or 3x the policy retention in any given policy period). This converts the policy to “First Dollar” coverage for all subsequent losses.

On one policy, we negotiated a clause saying that the carrier could not invoke the Hammer Clause if the settlement was within the retention. The rst example of this article has such language. This gave the Insured more leverage for rejecting a cheap settlement and mounting a defense. Appearing weak and rolling over for settlements in the EPLI world will turn you into a claim magnet, so often times, it is in your best interest to defend these claims, even if it is a bit more costly than just settling. Make sure your policy gives you this ability.

On other lines of coverage where there is not a real impetus to reject settlements, try to negotiate them as a non-critical issue. If you have other more pressing coverage issues, it is probably wise to not spend your negotiation capital on the hammer clause. It will not bring you that much value.

Finally, this article is, of course, educational in nature, so be sure to discuss the specifics of your insurance program and any claim with your broker or lawyer where applicable.